- #Information on quickbooks pro with payroll how to#

- #Information on quickbooks pro with payroll free#

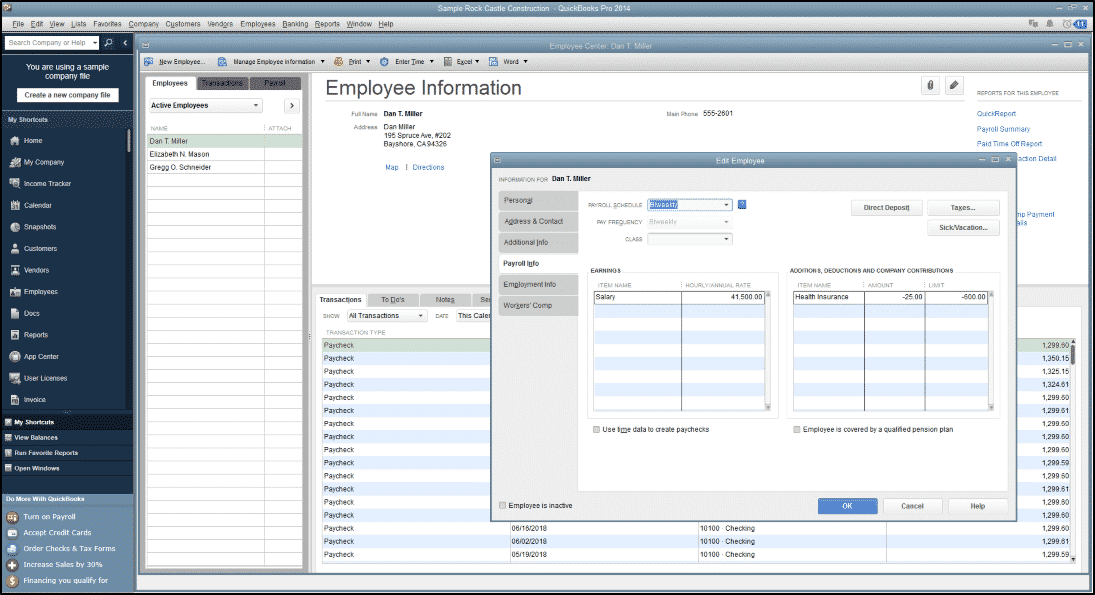

You might also want to check out IRS guidelines for company contribution limits: IRS Retirement Topics - Contribution Limits.įeel free to comment below if you need clarification about the retirement plans in QBO. I'm adding this article for more information: Retirement plan deductions/contributions. You can only make contributions to your Roth IRA after you reach age 70 ½. Your Direct Deposit paychecks are debited as a lump sum from your payroll back account and show up as a single payment in your QuickBooks check register. In addition, you can't deduct contributions to a Roth IRA as per the IRS guidelines. 4 Notes: Paychecks imported from Complete Payroll appear as journal entries in the QuickBooks check register, rather than paychecks or regular checks. This is because the entire contribution should be paid and reported separately through the provider and not through the same account as the employee after-tax deduction funds. QuickBooks Desktop Pro for Windows to track your business, organize finances and payroll in one place, and.

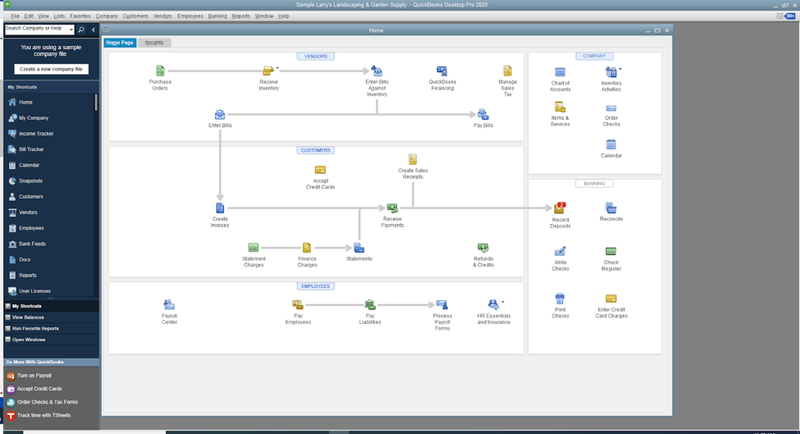

Thus, the Roth 401(k) and 403(b) aren't available as company contributions through our service. .contact information of QuickBooks support. Its basic plan has a high starting pricebut it’s offset by a low per-employee price that makes QuickBooks Payroll more affordable if you have more employees. Make sure that you have signed up for the plan that’s best for. The bottom line: QuickBooks Payroll is a user-friendly payroll solution with a comprehensive payroll app for on-the-go employers.

#Information on quickbooks pro with payroll how to#

QuickBooks Payroll Subscription: Unfortunately, QuickBooks Payroll does cost an additional fee each month. QuickBooks Desktop Pro 2019 payroll will describe the payroll process for a small business in detail, so bookkeepers, accountants, and business owners can better understand how to set up payroll, process payroll, and troubleshoot problems related to payroll. The regular 401(k) and the Roth 401(k) are different retirement plans. Prior Payroll Information: If you’ve currently been paying your employees, have your prior payroll information on hand so that payroll taxes can be accurately calculated. Your confusion ends here, me to fill you in on everything you need to know about the retirement plan deductions and contributions in QuickBooks Online (QBO) Payroll.

0 kommentar(er)

0 kommentar(er)